Business Information Systems: A Strategic Advantage for Entrepreneurs

/0 Comentarios/en Finanzas/por JORGE MONTES DE OCAIn today’s competitive environment, entrepreneurs must make fast and accurate decisions to differentiate and grow. This is where information systems become critical tools, turning raw data into valuable insights that support both daily operations and long-term strategies.

What are information systems?

An information system is a structured process that collects, processes, and distributes information to support decision-making within organizations (Gómez Vietes & Suárez Rey, 2007). In simple terms, it transforms data into actionable knowledge that allows entrepreneurs to identify risks, opportunities, and improvement areas.

Types of information systems and their value

Information systems operate at different organizational levels (Proaño, Orellana, & Martillo, 2018):

- Operational level (TPS): manage daily transactions such as sales, payments, or inventory.

- Knowledge level (KWS and Office Systems): support professionals who create and manage information, fostering productivity and innovation.

- Management level (MIS and DSS): provide reports and decision-support tools for managers, helping them analyze alternatives and scenarios.

- Strategic level (ESS): used by executives for non-routine, complex decision-making.

Additionally, specialized systems offer unique benefits for entrepreneurs:

- ERP (Enterprise Resource Planning): integrates finance, operations, logistics, and inventory into one system.

- CRM (Customer Relationship Management): strengthens customer relationships, attracting and retaining valuable clients.

- SCM (Supply Chain Management): optimizes supply chains, improving efficiency and reducing costs.

- GIS (Geographic Information Systems): analyze location-based data for strategic decision-making, such as logistics or marketing.

Applications for entrepreneurs

Information systems not only improve efficiency, they also enable growth and innovation. Their value depends on how they are embedded into the company’s culture and how strategically they are used (Stair & Reynolds, 2010).

For entrepreneurs, these systems mean:

- Better control over operations.

- Reliable information for faster decision-making.

- Greater agility to respond to market changes.

- Competitive advantages in cost efficiency, service, and differentiation.

The internet and ICT (Information and Communication Technologies) have accelerated this transformation, making information systems indispensable for businesses aiming to compete globally.

Conclusion for entrepreneurs

Running a business without information systems is like navigating without a compass: you may move forward, but with a high risk of losing direction. Accurate and timely information is the most valuable resource for making strategic decisions, identifying opportunities, and adapting to market changes.

If you are starting your business, begin with simple solutions—like a CRM or inventory management software—and expand to more comprehensive systems as your business grows. Remember: competitive advantage does not come from having data alone, but from interpreting and using it to create value.

Entrepreneurs who integrate information systems into their strategy not only manage their businesses more effectively but also build a strong foundation to scale, innovate, and sustain long-term success.

References

Gómez Vietes, A., & Suárez Rey, C. (2007). Los sistemas y tecnologías de la información en la empresa. México D.F.: Alfaomega.

Lapiedra, R. A., Devece, C. C., & Guiral, J. H. (2011). Introducción a la gestión de sistemas de información de la empresa. España: Universitat Jaume.

Proaño, M., Orellana, S., & Martillo, I. (2018). Los sistemas de información y su importancia en la transformación digital de la empresa actual. Revista Espacios, 39(1).

Stair, R. M., & Reynolds, G. W. (2010). Principios de sistemas de información: un enfoque administrativo. México D.F.: Cengage Learning Editores S.A. de C.V.

Information Systems for Entrepreneurs

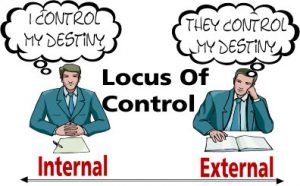

Locus of Control and Entrepreneurship: Whose Success Depends?